Generosity that Gives Back: Charitable Contribution Deductions

December 13, 2023When you donate to a charity, not only do you contribute to a noble cause, but you may also receive a benefit in return: a charitable contribution deduction. This financial incentive can make giving even more rewarding. In this article, we’ll explore how donating your car to Vehicles for Change can qualify for such deductions, making your act of generosity a gift that gives back.

Understanding Charitable Contribution Deductions

What is a Charitable Contribution Deduction?

A charitable contribution deduction allows taxpayers to deduct their donations to qualifying charities from their taxable income. This deduction can reduce your tax bill, depending on the value of your donation and your tax situation.

Qualifying for the Deduction

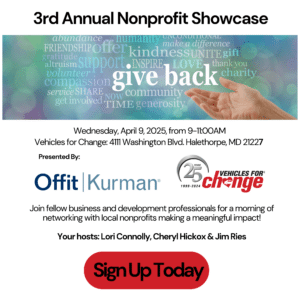

To qualify for a charitable contribution deduction, the donation must be made to a 501(c)(3) organization. Vehicles for Change is a certified 501(c)(3) nonprofit, meaning your car donation is eligible for this deduction.

How Donating Your Car Qualifies

Assessing Your Car’s Value

The deductible amount often depends on how the charity uses the vehicle. If Vehicles for Change uses your car in its program, you can typically deduct the fair market value. If the car is sold, the deduction is usually the sales price.

Receiving Documentation

After donating your car, Vehicles for Change will provide you with the necessary documentation, such as a receipt or Form 1098-C, which you’ll need for tax filing purposes.

Maximizing Your Deduction

Keeping Records

Keep detailed records of your donation, including any correspondence and paperwork provided by the charity. This documentation is crucial for tax purposes.

Understanding the Limits

There are limits to how much you can deduct. For tax year 2023, the limit on charitable cash contributions is up to 60% of your adjusted gross income (AGI) for cash contributions.

The Process of Donating Your Car

Step-by-Step Guide

- Prepare Your Vehicle: Gather necessary documents, such as the title and maintenance records.

- Complete the Donation Form: Fill out the donation form on Vehicles for Change’s website, providing details about your car.

- Schedule a Pick-up or Drop-off: Arrange a convenient time for the vehicle to be picked up or drop it off at a designated location.

- Receive Your Tax Documentation: After the donation, you’ll receive documentation indicating the value of your contribution for tax purposes.

Frequently Asked Questions

- Q: Do I need to itemize my deductions to claim a charitable contribution deduction?

- A: Yes, to claim a charitable contribution deduction, you must itemize deductions on your tax return instead of taking the standard deduction.

- Q: How do I determine the fair market value of my car?

- A: Fair market value can be estimated using various car valuation guides, but the final deductible amount will depend on how the charity uses the vehicle or the sale price if it’s sold.

- Q: What if my car is valued at more than $500?

- A: For cars valued over $500, additional IRS forms may be required. Vehicles for Change will provide you with all the necessary documentation.

Conclusion

Donating your car to a charity like Vehicles for Change not only supports a worthy cause but also offers the benefit of a charitable contribution deduction. This win-win scenario makes your generosity even more meaningful. Remember to keep good records, understand the tax implications, and consult a tax professional if needed. Your act of giving can be a rewarding experience in more ways than one.