Help a Family Today!

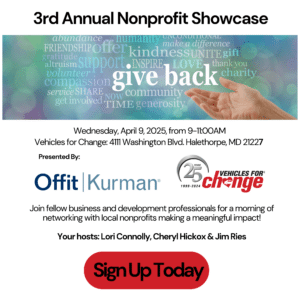

Support Vehicles for Change

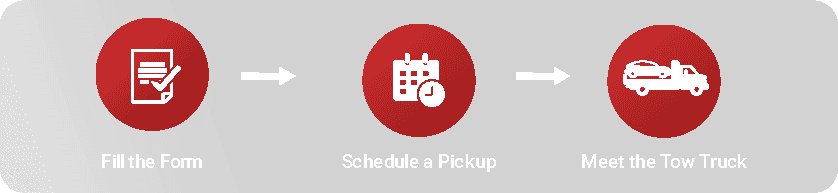

Your donation helps Vehicles for Change bring independent transportation and workforce training in the automotive field to as many people as possible.

Any necessary legal language about your organization’s status, as needed. If you plan to embed this into your website and your website footer already features this language, you can delete this section. This is also true of the social media and contact information below.