Best Practices when Donating a Car to Charity

November 19, 2015

Do your research. Car donation charities work in different ways. Some simply sell the cars to the highest bidder and use the money to benefit those in need. Others give the cars to people who cannot afford them, and others repair the cars and sell them to people in poverty for a much reduced price.

Learn about all of the different options available to you, and make your decision based on which methods you think will most benefit the financially struggling people in your community. Contact the different charities in your area and hear their reasons for why you should donate, and make a final decision based on the benefit to you and the benefit to those you are helping.

- Make sure the charity is tax-exempt. One of the benefits you receive when you donate a car to charity is a tax break. However, if the charity you donate to is not recognized by the IRS, you may not receive a tax deduction. Furthermore, if the charity is not tax exempt, it may not be the best or most philanthropic charity to donate to.

- Know how the charity will use your car. The amount of your tax deduction is determined in part by how the charity uses your donated car. It is important when you donate a car to charity to know what it will be used for. It is also important to find out how that use benefits the people the charity supports. This lets you make an informed decision based not only on the tax benefits to you, but the benefits to the recipients of your donation.

- Know the value of your car. The other factor deciding the amount of your tax break is the value of your car. The laws regarding car donations have changed and the value of your tax deduction is determined by how the charity uses the vehicle. . Knowing the value of your car will let you make an informed decision.

- Follow protocol when transferring the car. Make sure you remove all license plates, bumper stickers, and any other important or valuable personal information from the car before donating it. Transfer the title of your car to the charity, and follow all legal protocol for transferring ownership of the car.

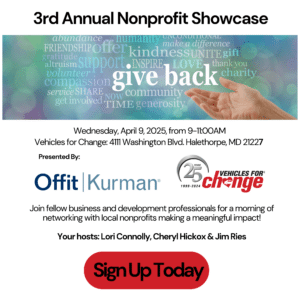

You can learn more about how to donate a car to charity online or by contacting Vehicles for Change.