How to Find the Best Car Donation Program

January 7, 2016

They use a “middleman” and that can often cut the value of the donation (the amount received by those in need) significantly.

Cut the charity middleman

Avoiding a middleman is possible. Donors can find out whether a charity is operating independently or not by calling and asking how much of a charity’s donations are used to help people in need.

Tax benefits of donations

When tax benefits are important, donors must find a charity that qualifies for tax exempt status. This means the charity has been approved by the IRS as a 501 (c) (3) organization.

Donors should always verify a charity’s tax-exempt status before committing to any vehicle donations. It is also important to be aware of the limits the IRS places on charitable donations per income.

Direct Donations

It is worth taking the time to look for a reputable charity with direct car donation programs. A charity’s reputation can be checked online through charity watchdog websites.

Charities that accept car donations may use a third party to pick-up or tow away the donor’s vehicle. This is convenient for the donor, but may place the cost of moving the vehicle on the charity.

To avoid paying a third party, donors can drive the care to the charity. This helps charities get more out of the vehicle’s value if it is sold or auctioned.

What does 501 (c) (3) mean?

There are many organizations who have non-profit status, but that does not make them tax deductible. To deduct a vehicle donation on taxes, donors need to be certain the receiving organization is classified as 501 (c) (3).

A 501 (c) (3) organization has public charity status and is not a political organization with lobbying power.

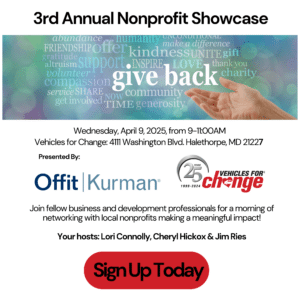

If you are interested in car donation programs without a middle-man, contact Vehicles for Change today for more information.