What is an Appropriate Amount to Donate to Charity?

January 25, 2023

For starters, any amount you can donate is helpful. While the saying, every little bit helps, can sound cheesy and a bit cliché, it’s also true. Every dollar adds up, and because charities and non-profits can often stretch each dollar further than the average person, a small amount can go a long way.

Donating even a small amount really can benefit others and help you feel like you’re a part of something bigger than yourself. That said, while it depends on where you live and how much money you make, the average person donates about 2-5% of their annual income to charity. However, even starting with donating 1% of your income to charity is a great place to begin.

Create a Budget Plan for Charitable Giving in the New Year

Creating a budget plan for charitable giving in the new year is a great way to start the year giving back. And as the saying goes, failing to plan is planning to fail! When you add donations to your budget or create a budget plan solely for charitable giving, you are more likely to keep your spending in check and give regularly. You can choose to donate all of your money to one organization throughout the year or donate a little bit of money to many charities close to your heart – there is no wrong way to donate!

With that said, when it comes to receiving a tax deduction, only specific donations are eligible. For example, suppose you gave money to a person experiencing homelessness on the street or donated to a political campaign (or an organization that focuses on lobbying). In that case, you will not be able to claim these as donations when filing your taxes. However, monetary donations made directly to a charity usually will be tax deductible as long as they are a 501 (c)(3). Make sure you research the charity you’re interested in donating to before choosing. Go to the IRS’s Tax Exempt Organization Search to confirm that the organization is tax-exempt and eligible to receive tax-deductible charitable contributions.

Remember you can also donate your time and resources when considering what is an appropriate amount to donate to charity. For example, you can sign up to cook a meal during the holidays for a shelter or volunteer your time tutoring students who need academic help. There is no wrong way to donate, so start thinking about causes you’re passionate about and see what you can give.

Contact Us Today

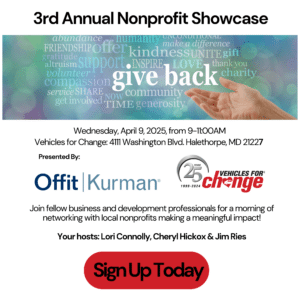

Vehicles for Change offers different ways to donate. We are the nation’s most extensive affordable car ownership program. When you give a family a car, you also are giving them access to employment opportunities, fresh food, recreational activities, and education. You can also choose to gift Vehicles for Change with a monetary donation, which we use to repair donated cars, train and pay our employees in our re-entry program, Full Circle Auto Repair & Training, and reach more families in need. Learn more about our mission here. We are grateful to donors like you who help improve the world.