3 Common Car Donation Tax Deduction Errors

January 28, 2016

Filing taxes can be a daunting task, and car donation tax deductions can seem especially confusing at first.

The three most common mistakes people make when filing for car donation tax deductions are:

- Missing forms (especially 1098-C)

- Mistaking quid pro quo donations

- Not choosing a reputable organization

Avoid these mistakes, and even first-time car donors can normally clear every hurdle without problem.

Here are some tips to help you get the most out of your vehicle donation.

Tax Deduction Forms

Car deductions over $500 require donors to fill out IRS forms. Vehicles for Change provides a tax receipt to the donor of each vehicle, once the donated vehicle is processed. When a donated vehicle is sold for more than $500, Vehicles for Change sends donors the IRS tax form 1098-C.This form is sent within 30 days of the vehicle being sold.

Not Verifying the Organization

The easiest car donation tax deduction mistake to make is not verifying the organization. Many organizations can claim non-profit status, but that does not mean the donor will be eligible to claim their donation as a tax deductions. A qualifying organization will be registered with the IRS as tax exempt. This means the charity will have 501 (c) (3) status as a public charity.

Non-profit charities with lobbying power may accept vehicle donations, but donations cannot be deducted from taxes. These non-profit organizations have political lobbying power and are 501 (c) (4) organizations.

To confirm the tax status of the organization, the donor can ask whether donations are tax exempt or check out the charity’s tax status online.

To avoid tax deduction mistakes, donors should keep all receipts and forms related to the donation, know the value of the car and deduction limits placed on donations by the IRS, and verify that the organization or charity is tax-exempt.

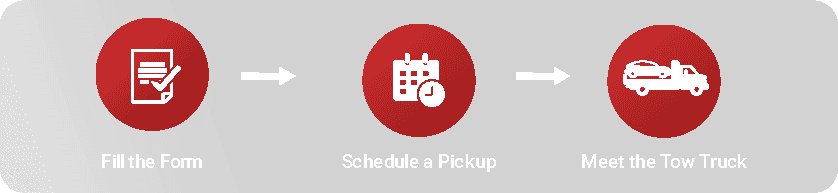

Contact Vehicles for Change today, if you need help planning your vehicle donation or have any additional questions.