Car Donations and Tax Deductions

July 20, 2014

If Your Vehicle is Awarded to a Family

Your tax deduction would be the fair market value of the vehicle and you should receive a tax letter within 30 days of the vehicle arriving at VFC’s lot.

If Your Vehicle is Sold at Auction

Your tax deduction would be the selling price of the vehicle and you should receive a tax letter within 30 days of the vehicle’s sale date.

If Your Vehicle is Sold on VFC’s Retail Lot

If the vehicle requires major repairs, your tax deduction would be the fair market value of the vehicle minus the estimated cost of repair. Vehicles for Change will send you both of these values in your tax letter. You would receive this tax letter with 30 days of VFC determining that the vehicle needs major repairs.

If the vehicle doesn’t require major repairs, your tax deduction would be the selling price of the vehicle. You should receive a tax letter within 30 days of the vehicle’s sale date.

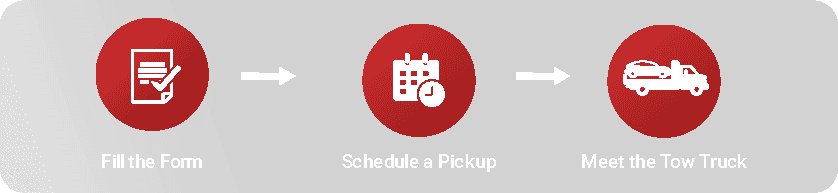

Want to maximize your tax deduction? Complete our online donation form today!